The highlighter budget method is perfect for those who hate spreadsheets. It’s one of the easiest ways to track your expenses, which is an essential first step in any good financial plan. A lot of people don’t know where to start with a budget or financial plan, and therefore never start at all. If this describes you, you are not alone! So many people are intimidated by budgeting. But don’t worry! The highlighter budget is simply looking at how you have already spent your money. Then you get to decide if you want to continue spending it this way.

Find your Bank and Credit Card Statements

Find or print out your latest bank statements for all your chequing and savings accounts. Find or print out the most recent statements for all your credit cards. It doesn’t really matter if they are from the 1st to the 31st of the month, or if the bank statements are for the same dates as the credit card statements. They will both cover one full month of information.

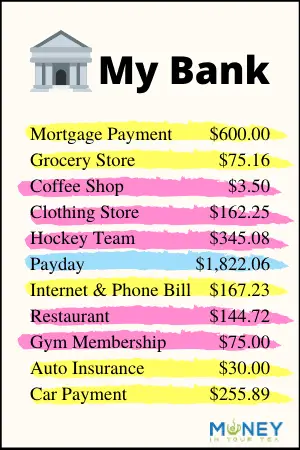

I’m going to suggest highlighting your income in blue, needs spending in yellow, and wants spending in pink highlighter. If you want to focus on a subcategory of these, simply grab another highlighter colour. For instance, if you think you might be spending too much on eating out, you might want to highlight those in green.

Highlight your Income in Blue

Go through your bank statements and highlight any income in blue. This includes the direct deposit salary from your job, any cash you received, rental income if you have that, government transfer payments such as child benefits, and so on.

Highlight your “Needs” in Yellow

Your needs are the things that would be life-changing if you had to do without them. It includes the following:

- Rent or mortgage

- Utilities such as electricity, gas, and water bills

- Transportation costs, including car payments, insurance, gas, servicing and repairs, as well as taxi/Uber, public transit, etc.

- Payments on any loans, lines of credit, or credit card debt

- All types of insurance, including health, life, disability, home etc.

- Groceries, but not any other food or drink

- Medical care

- Daycare for your child so that you can work

- Grooming, such as regular haircuts

Notice that some of the things in this list will be fixed expenses that aren’t easily changed, such as your mortgage payment. But others may have a bit of flexibility, such as the types of groceries you buy or shopping at a discount store.

Highlight your “Wants” in Pink

Wants are the fun things in life, the experiences and purchases that bring joy and memories. These include:

- Entertainment – tickets to an event or a movie, memberships, subscriptions, Netflix and cable TV

- All non-grocery food and drinks, including alcohol and bars, restaurants and take-out

- Charity – I would classify this as a “want” but if it feels like a “need” to you then feel free to put it in that category

- Gifts and parties

- Home and garden expenses

- Kids’ activities

- Gym membership, hobbies, etc.

- Manicures, spa days, etc.

- Shopping for clothes, books, electronics, hobbies, sporting goods, and more

- Travel

If you’ve got a few lines in your statements that aren’t highlighted yet, go back and consider whether they are needs, wants, or something else. We aren’t looking at transfers to investment accounts today, so those won’t be highlighted.

Add up your Categories

Now that your bank and credit card statements look like a rainbow of colours, get out your calculator app and add them up!

Add all the blue highlighted lines to get your total income over a one-month period.

Then add up all your yellow lines to find out how much you spend on needs each month.

Lastly, add up all your pink highlighted lines to discover how much you spend on wants in a month.

If you think that the most recent month is an outlier in terms of income or spending – maybe you had a big car repair bill that month – consider grabbing another couple of months of statements. Highlight those in the same way, and take the average income and spending of the whole period.

Take a Good Look at your Total Spending in Each Category

When doing the highlighter budget method, you will see quickly and easily where you money goes each month. One category we didn’t highlight was investing. That is, transfers to your retirement account, emergency fund, education fund, or other types of saving and investing.

If you’re living paycheque-to-paycheque I think you’ll find one of two things. Either you have a spending problem or you have an income problem.

Do you have a Spending Problem?

Look at your “wants” spending, which we’ve highlighted in pink. If it’s more than about 30% of your income, then consider cutting back somewhere. This includes restaurants and take-out food, coffee shops, entertainment, and shopping. Pick a target that will be easy for you to achieve. For instance, maybe you could cut back by $50 on eating out. But telling yourself that you won’t eat out at all next month is probably not realistic.

Another great idea is to spend less on recurring items. For example, call your cable or phone provider and ask what is their best rate right now. Do some online searching for your area to learn about other options. Call your insurance providers and ask for a better rate. Call your bank and negotiate a better interest rate on your mortgage and other loans.

Do you have an Income Problem?

If your “wants” spending is already well under 30% of your income then you have an income problem. In this case, consider how you can boost your income. This might include:

- Working more hours at your existing job

- Asking for a raise (ensure you can demonstrate why you deserve it!)

- Finding a better paying job

- Picking up some side income such as walking dogs

- Renting out a spare room in your home

- Teaching music lessons or tutoring school children

Highlighter Budget

Now that you have your exact spending totals for each category, you are able to think about putting together a budget plan. Check out my 50/30/20 budget rule for an easy way to do your financial plan!

When the next month’s statements come in, you can redo the highlighting to see if your spending is down or your income is up.

This article was originally published on Money In Your Tea, click here to view.