Deal with the past, live well in the present and prepare for your financial future.

In mid-2015, I was broke, had large amounts of debt and was under debt review for it, my business was struggling to get off the ground and I was at a total financial low point. Fast forward to today, my debts are all cleared and I now have multiple income streams I use for saving, investing, and to support my lifestyle. I wanted to share that story with you to show you that no matter how dire your situation may seem right now, you can turn it around.

When it comes to sorting out our finances, many of us are bamboozled as to where to even start! In this article, I share the 3 steps to achieving the financial freedom that you can take right now.

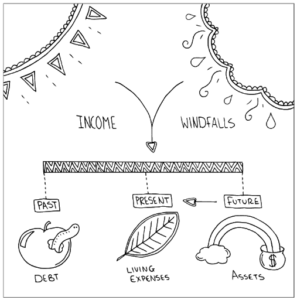

The following illustration shows the flow of money into and out of your life:

When money flows into your life, you can direct it to flow to one or more of these three categories – past, present, and future.

Clearing the past: Deal with your Debt

Debt can wreck your relationships, affect your mental and physical health (stress!), and ultimately destroy your life. This does not have to be your story! It doesn’t matter what situation you find yourself in at this moment, there is a way out! Seek help if you need to – support goes a long way!

- Make a list of your debt, the interest rates, and minimum payment amounts. Knowledge is power!

- Start by paying extra towards your smallest debt (emotional wins). Once an account is paid up, add the amount you were used to paying, to the next creditor’s payment. This way you not only pay your debt off faster, but you will also save on interest. Bonus!

- Stop making more debt! Cut up your credit cards, close your accounts. This one is particularly hard when you’re living off debt but closing accounts one by one and getting down to having just 1 credit card is fantastic progress.

- Forgiveness is important when dealing with debt. The past is over. Mistakes have been made. Debt does not need to be a life sentence. It’s time to let the past go and take daily steps towards a brighter debt-free future!

Live well in the present: Spend less than you earn

How are you looking after the money that comes into your life? Are you spending every last penny and then some more? Are you perhaps drowning in debt with no savings to show?

It’s time to get clarity and take control of your monthly expenditure:

- List all your fixed monthly bills (such as rent, insurances, utilities) and then your discretionary spending (e.g. food, entertainment, personal spend). Give your budget a spring clean. Perhaps it is cluttered with unnecessary expenses? Prioritize what is important to you. Eliminate waste and spend on things that no longer add value to your life.

- Create a buffer – if you only apply one practical habit in your life after reading this, this should be it! This is your peace of mind fund – especially when paying off debt! Build a buffer of at least one month’s worth of living expenses. Put this buffer in a separate account. Whenever money comes into your life allocate an amount towards your buffer BEFORE spending it on anything else! Yes, save before you spend. The initial amount does not matter, what is important is that you create the habit of saving. You are creating your safety net by doing this. When unexpected events occur, you can be your bank and line of credit, and not resort to further debt! This money is only to be used for occasional events and not for everyday expenses. This is key in breaking the spiral of debt.

- Don’t deprive yourself – Figure out what those things are that make you FEEL good (massages, hair care, eating out, holidays) and find ways to include them in your monthly expenditure. Find cheap deals, discount offers, 2 for 1 special, use shopping points, free experiences, etc but do those activities so you’re not left feeling like you’re not living your best life.

Prepare for the future: Start Saving

Are you preparing for the future? They say the best time to start saving for your financial freedom (when you no longer need to work for money) is the day you draw your first salary. The next best time to start saving is now. Today.

Understandably, if debt is still a major factor in your life, your savings and investments will be on a smaller scale. The key is to start, however small. Start with R10 a week if you have to. That will get your saving mindset activated. Educate yourself on different investment and retirement options and start putting a plan in place. As you eliminate debt from your life, you will be able to allocate more and more towards your future. This is where money thrives! And this is where the money that you’ve worked for, will start working for you instead!

A healthy financial freedom plan may include the following:

- A cash-based buffer of 3 – 6 months worth of living expenses

- Retirement funds (country dependant)

- Tax-Free Investment funds (country dependant)

- Unit trusts/stock market investments

- Other passive income streams

Take the time to educate yourself on all the different options and start implementing your financial freedom plan, step by step. When money becomes a partner in your life instead of a slave driver, you will discover a harmony that you didn’t even know existed before!

When you implement something you have learned, you have a far better chance of success!

Think about your current money situation.

Which area in your financial life needs the most urgent attention? Past, Present, or Future?

Which of the steps above can you start with immediately?

Can you commit to making a list of steps that you can take from the list above and taking just 1 step every week until you are done with the list?

Blog originally published by Marnita Opperman – Mindful Money Coach